VIES and INTRASTAT are two important EU customs and statistical reporting systems that companies engaged in intra-EU trade need to fully understand. This in-depth guide explains everything businesses need to know to properly comply with VIES and INTRASTAT requirements.

Mastering VIES and INTRASTAT reporting is crucial for smooth EU trade.

VIES stands for VAT Information Exchange System. It is a system of information sharing between EU tax authorities to monitor VAT-exempt intra-EU transactions.

Introduced in 1993, VIES places certain obligations on traders making intra-EU supplies to provide data to tax authorities on these transactions. The aim is to prevent VAT fraud like missing trader fraud in intra-EU trade.

Under VIES reporting, companies have to submit regular declarations with details of their intra-EU supplies of goods and services to VAT registered customers in other EU countries.

Each EU country stores VIES data in a national database accessible to other member state tax authorities for VAT control purposes.

If you are VAT registered and making intra-EU supplies, your main obligations under VIES include:

VIES reporting applies only for supplies made to VAT registered business customers in other EU countries. Supplies to non-VAT registered customers do not get reported.

Sales invoices to EU business customers must contain both your VAT number and the customer's VAT number, properly formatted, for VAT zero-rating eligibility.

There are no thresholds under VIES - all VAT registered intra-EU traders must file VIES returns regardless of the value or volume of transactions.

VIES reporting is mandatory on a monthly basis if intra-EU goods supply values exceed €50,000 during any month. Otherwise quarterly reporting can be used. For services, quarterly reporting is the default with the option to voluntarily file monthly instead.

If you make no intra-EU supplies in a period, you must still submit a "nil" VIES return to declare this.

You must start submitting VIES returns from the period in which you first make an intra-EU supply of goods or services after becoming VAT registered.

VAT registration applications after June 2019 have a specific "domestic-only" or "intra-EU" designation. Only intra-EU registrations trigger VIES return obligations.

If you already have a VAT number issued before June 2019, this is considered an intra-EU registration so VIES requirements apply if you make intra-EU supplies.

The deadline for filing your VIES return is the 23rd day of the month after the return period ends.

Now that we've covered the basics of VIES, let's look at the detailed steps involved in preparing and submitting your VIES returns correctly:

Your VIES return must include:

You only need to report total supply values per customer VAT number. Individual transaction details do not need to be reported.

If you issued any credit notes during the period, these would reduce the total values declared for the affected customers.

VIES returns must be submitted electronically in the required XML file format. Fortunately, tax authorities provide ways to easily create VIES returns in this format:

Paper VIES returns are no longer accepted. The proper VIES digital formats ensure fast and accurate processing of your return data by tax authorities.

The easiest way to file your VIES returns is to use the online form available on your tax agency's portal website.

For example, Ireland's tax authority Revenue provides an online VIES return form on its ROS portal. You log in to ROS using your digital certificate, select the VIES return and fill in your supply details per customer VAT number for the period.

Once submitted, the portal generates a PDF receipt as proof of your VIES filing.

This digital certificate login allows tax authorities to securely identify you as the VIES return filer.

For VIES returns with a larger number of intra-EU customers, online data entry on the portal may be cumbersome.

In this case, you can use spreadsheet templates provided by tax authorities to record details of all your VIES supply data offline.

For example, Revenue offers a VIES Excel template on ROS that can handle up to 6,000 supply lines. You fill this up offline then upload the completed template back onto ROS to file your return.

Again, your digital certificate is used to authenticate that you are submitting the uploaded VIES return spreadsheet.

Online portals may also have data validation checks before accepting your uploaded VIES return to spot any obvious errors for correction.

Larger businesses with very high volume VIES reporting needs can choose to integrate directly with the tax authority's VIES filing API to automatically generate and submit VIES returns in the required standard XML format.

For example, Revenue offers a Secure File Transfer Protocol for high volume VIES return filers to transmit XML submission files. Access is provided after registering as a large filer.

Here, VIES return data extracted from the company's ERP system is mapped to the required XML file structure and pushed to Revenue's API endpoint using suitable connectors.

As before, digital certificates are used to authenticate the identity of the business submitting each VIES return via the API channel.

If you discover an error in a VIES return already filed, you must submit an amendment return to correct it.

Online portals provide an easy way to make corrections to your most recent VIES returns. You access the return for that period, amend the data as required, and submit the corrections.

For older VIES periods beyond the online correction window, you may need to submit a separate VIES correction return indicating the period, original data, and corrected information.

Corrections should be submitted as soon as errors are discovered to ensure tax authority records are updated with the right VIES data.

Besides online filing, tax authorities offer various resources to assist with VIES reporting compliance:

These resources are extremely helpful for new VIES filers or when dealing with complex VIES reporting scenarios.

Now that you have a broad overview of VIES reporting, let's examine some common scenarios you may encounter and how to handle VIES reporting in those cases:

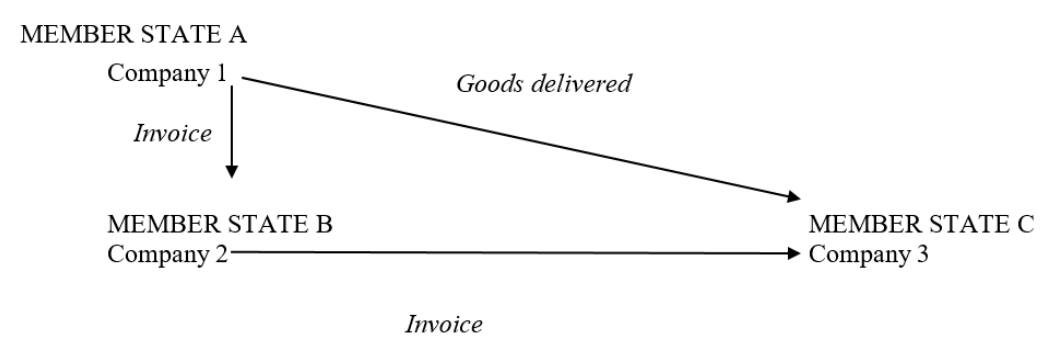

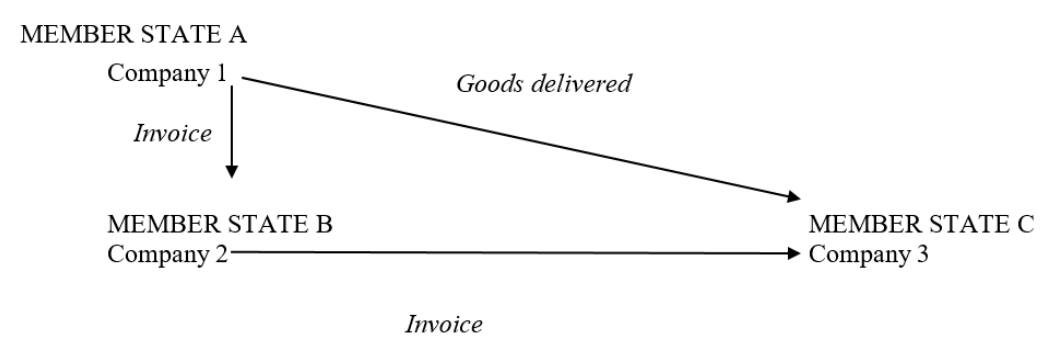

Triangular transactions involve a supply chain with 3 companies - A, B and C. Company A in France sells goods to Company B in Ireland. But Company B instructs Company A to ship the goods directly to Company C in Germany.

Here, Company A reports the supply on its French VIES return showing Germany as the destination country. Company C, the actual recipient of the goods, reports the arrival on its German VIES equivalent as an intra-EU acquisition from France.

Company B does not report this supply on its Irish VIES return since the goods never entered or left Ireland. But any other intra-EU supplies that B makes get reported normally.

|

| Triangulation |

Call-off stock refers to goods shipped by the supplier to the customer's location but held in stock. The customer subsequently takes ownership only when calling off those goods from the stock as needed.

Here, the supplier reports the goods movement in its VIES return for the period when the goods were first shipped. The customer reports its intra-EU acquisition on its VIES only when ownership is taken by calling off those goods from the stock.

For intra-EU distance sales to non-VAT registered individuals, the general VIES reporting rules apply. If you exceed the distance selling registration threshold for another EU country, you must register for VAT there and report intra-EU supplies to that country in your VIES return.

If you are shipping goods to another EU country for installation or assembly there, you must include the value of these goods in your VIES return. The customer would report the arrival as an intra-EU acquisition on its local VIES equivalent.

If you are installing goods shipped from another EU country, you report the arrival in your VIES once the installation is complete and you take ownership of those installed goods.

Goods returned from customers in another EU country should be reported in your VIES return for the period in which they are returned. You can offset the value against your total supplies to that customer VAT number during that VIES period.

Credits, rebates or discounts granted to EU customers get reported as negative amounts in your VIES return reducing the total supplies for that customer VAT number. Ideally in the same period but if not, then in a subsequent period.

The transfer of goods between group companies in different EU countries are deemed intra-EU supplies and must be reported on VIES. The value to declare for intercompany transfers is the market value of the goods transferred.

This reporting helps prevent abuse of VAT-free movements within a single company.

A critical part of VIES reporting is verifying your EU business customers' VAT registration numbers quoted on purchases.

You can validate VAT numbers via the EU's official VIES VAT Number Validation site.

Key things to note:

Invalid customer VAT numbers may get flagged during tax authority VIES return validation leading to queries or penalties if not corrected.

As part of the interlinked nature of VIES reporting, you also need to provide certain information related to your VIES declarations to business customers when requested:

Provide this to help customers verify and reconcile your VIES declarations to those they need to submit in their country.

Be sure to only share details of supplies made to that specific customer. Other customer data must remain confidential.

Keep documentation of information requests received and your responses provided to customers for audit purposes.

As part of enforcing VIES reporting obligations, tax authorities may conduct compliance visits to review your records, systems and processes.

Some key areas they can examine include:

Make sure your documentation clearly supports the intra-EU transactions declared on your VIES returns.

Penalties can apply for breach of VIES reporting obligations such as:

Appoint someone to monitor VIES compliance requirements and take corrective action promptly if issues arise. Maintaining robust VIES compliance helps avoid penalties.

Brexit has significantly impacted VIES reporting requirements for trade with the UK.

Since January 2021, the UK is no longer part of the EU VAT territory. This means:

However, Northern Ireland remains aligned to EU VAT rules under the Northern Ireland Protocol. Therefore:

If you were previously reporting UK VAT numbers, be sure to remove these from January 2021 onwards and instead treat UK transactions as exports on your VAT returns.

Let's now shift gears to look at INTRASTAT - the EU system for collecting statistics on intra-EU trade in goods.

INTRASTAT replaced customs documentation from 1993 once physical borders were abolished between EU countries.

Under INTRASTAT, companies provide detailed statistical data to customs authorities on goods:

This data enables compilation of EU trade statistics needed by customs, tax authorities, statistical offices, businesses, economists and other stakeholders.

INTRASTAT applies to VAT registered entities with goods trade above set annual thresholds:

If your trade exceeds the thresholds, you must file detailed INTRASTAT declarations - even for "nil" periods.

Thresholds are based on previous year trade levels and determined annually.

You must start filing INTRASTAT declarations in the period your EU trade first exceeds the relevant dispatch or arrival threshold.

For example, if you exceed the €500,000 arrival threshold in October 2023, you must start submitting detailed INTRASTAT arrival declarations from October 2023 onwards.

You continue filing for the rest of that calendar year and the year after unless your EU trade falls back below the thresholds.

INTRASTAT requires various data fields to be reported in your declarations:

Statistical value and net weight also required if above high value thresholds. You must report transactions when ownership or physical movement occurs - whichever is earliest based on VAT rules.

INTRASTAT declarations must be submitted monthly and received by the 23rd day after month end.

For example, the January INTRASTAT return is due by 23rd February.

Quarterly reporting is not permitted even for businesses below the dispatch and arrival thresholds.

An important step in INTRASTAT reporting is classifying goods using the correct commodity code:

Classifying goods correctly requires understanding what each CN code represents.

Tax authorities provide extensive online guidance and tariff databases to assist with identifying suitable commodity codes.

For example, Ireland's Revenue offers a free Tariff Classification Search tool.

Their classifiers can also help if unable to determine a suitable code yourself.

Commodity code databases are updated annually so always use the current version applicable to your INTRASTAT filing period.

Now let's explore the main approaches for submitting your INTRASTAT declarations:

Most tax authorities provide online INTRASTAT portals allowing manual data entry or file uploads.

For example, Ireland's ROS portal allows:

The portal uses your digital certificate for secure login and submission.

Tax authorities provide Excel templates enabling offline preparation of INTRASTAT data for upload.

For example, Ireland offers the ROS Offline Application for populating INTRASTAT Excel templates.

Once completed, these can be uploaded to the online portal for submission.

This avoids manual online entry but still allows some structured data checks before filing.

Larger companies can invest in automating INTRASTAT filing by:

For example, Ireland offers a Secure File Transfer Protocol API for automated INTRASTAT filing.

This requires IT effort but reduces manual processes and improves data accuracy.

Useful resources offered for INTRASTAT filing include:

These help ensure complete and accurate INTRASTAT declarations.

INTRASTAT reporting has specific rules for certain transactions:

Goods sent to another EU country for processing are declared on dispatch at their value when sent. After processing, the return movement is reported on arrival at the new enhanced value after processing.

Goods sent to another EU country for repair are reported on dispatch at their value when sent. Return movements after repair are reported on arrival at the repaired value.

Replacement goods sent free of charge to another EU country are excluded from INTRASTAT. However, return of defective goods being replaced are reported.

The value of goods shipped for installation or assembly in another EU country is reported on dispatch. The recipient reports the arrival after successful installation when ownership transfers.

Conversely, arrivals of goods from the EU for local installation are reported on the INTRASTAT arrival after installation when ownership changes.

In triangular trade, goods move directly from country A to C though sold by B to C. Here, A reports dispatch to C and C reports arrival from A only. B does not declare a dispatch since the goods never enter or leave there.

Like with VIES, INTRASTAT compliance visits aim to verify your reporting workflows match actual intra-EU goods movements:

Areas Checked During INTRASTAT Audits:

The penalties for breaching INTRASTAT obligations can include:

Having robust INTRASTAT compliance controls will help avoid penalties during audits.

Brexit has also affected INTRASTAT reporting requirements:

Ensure previous GB transactions are removed from declarations and customs procedures used for trade with Great Britain.

VIES and INTRASTAT reporting are mandatory for all VAT registered EU businesses engaged in intra-EU trade of goods and services. With strong compliance processes, your business can avoid penalties and reap the benefits of smooth intra-EU trade!